Riverside Resources Sells Its Geraldton Greenstone Belt Canadian Portfolio to iMetal Resources Inc for Shares And 2.5% NSR

Vancouver, British Columbia--(Newsfile Corp. - February 10, 2021) - Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY) ("Riverside" or the "Company"), is pleased to announce the sale of the Company's Oakes, Pichette and Longrose Projects in northwestern Ontario for eight (8) million common shares, a 2.5% NSR and cash considerations to iMetal Resources Inc. ("iMetal") (TSXV: IMR) (OTCBB: ADTFF) (FSE: A7V2). The Riverside projects are located in the Beardmore Geraldton Greenstone Belt (BGGB), northeast of Thunder Bay, Ontario. iMetal has exploration projects in the Abitibi Greenstone Gold Belt and upon closing of this transaction Riverside will be a cornerstone shareholder in this new collaborative Canadian-focused gold exploration company. Highlights from the three Riverside projects include:

- The Oakes Project is 8000 hectares and host to several gold bearing shear zones. Channel sampling by Riverside (2019) of Trench 1 in the HG shear zone returned values of 31.9 g/t gold, 19.7 g/t gold and 6.9 g/t gold over 0.5 to 1.0 m intervals.

- The Pichette Project is 1,650 hectares and hosts gold in banded iron formation. Historic drill intersections of 4.78 g/t gold over 0.65 m and historic surface grab sample highlights of 24.55 g/t gold, 21.42 g/t gold and 16.01 g/t gold. Source (PME) 1990 42E12NE0168.

- The Longrose Project is 360 hectares and adjacent to the historic Leitch and Sand River Mines and hosts gold quartz veins. Drill highlights include 30.8 g/t gold over 0.15m and 10.28 g/t gold over 0.45m from quartz veins (Longrose Gold Mines, 1947).

Riverside's President and CEO, John-Mark Staude: "We are pleased to sell our mineral claims and join these projects with iMetal Resources' portfolio of Abitibi gold projects toward building a strong collaborative business. Collectively these projects will create an exploration company with tremendous upside for high-grade gold in some of the highly endowed greenstone gold belts of Canada's top two gold producing provinces. Riverside retains a 2.5% NSR on each property plus a significant share position in the equity of iMetal; collectively giving Riverside shareholders exposure to future project and corporate successes as iMetal moves towards active exploration and drilling programs across this combined portfolio."

The Transaction

iMetal will issue 8 million shares from treasury upon TSX Venture Exchange approval to Riverside to complete the transaction. There are no work commitments. Riverside is entitled to a one-time bonus payment of $500,000 in cash or shares at iMetal's option in the event a drill intersection in excess of 100-gram-metres is reported. Riverside will retain a 2.5% Net Smelter Return (NSR) Royalty on materials other than Cu, Pb, Zn which will be a 1.5% NSR. iMetal will have the option to purchase 1.5% (60%) of the NSR within 5 years of closing of the transaction as follows: first 0.5% for $500,000, second 0.5% for $2,000,000, third 0.5% for $5,000,000 for materials other than Cu, Pb, Zn.

Riverside's technical team will design and manage the exploration programs at the Oakes, Pichette and Longrose Projects. Riverside will also act as technical advisors for the Gowganda exploration programs. See below for more information on Gowganda West.

Concurrent iMetals Financing

A condition of closing includes the completion of a financing of $2,500,000. Terms to be determined by iMetal.

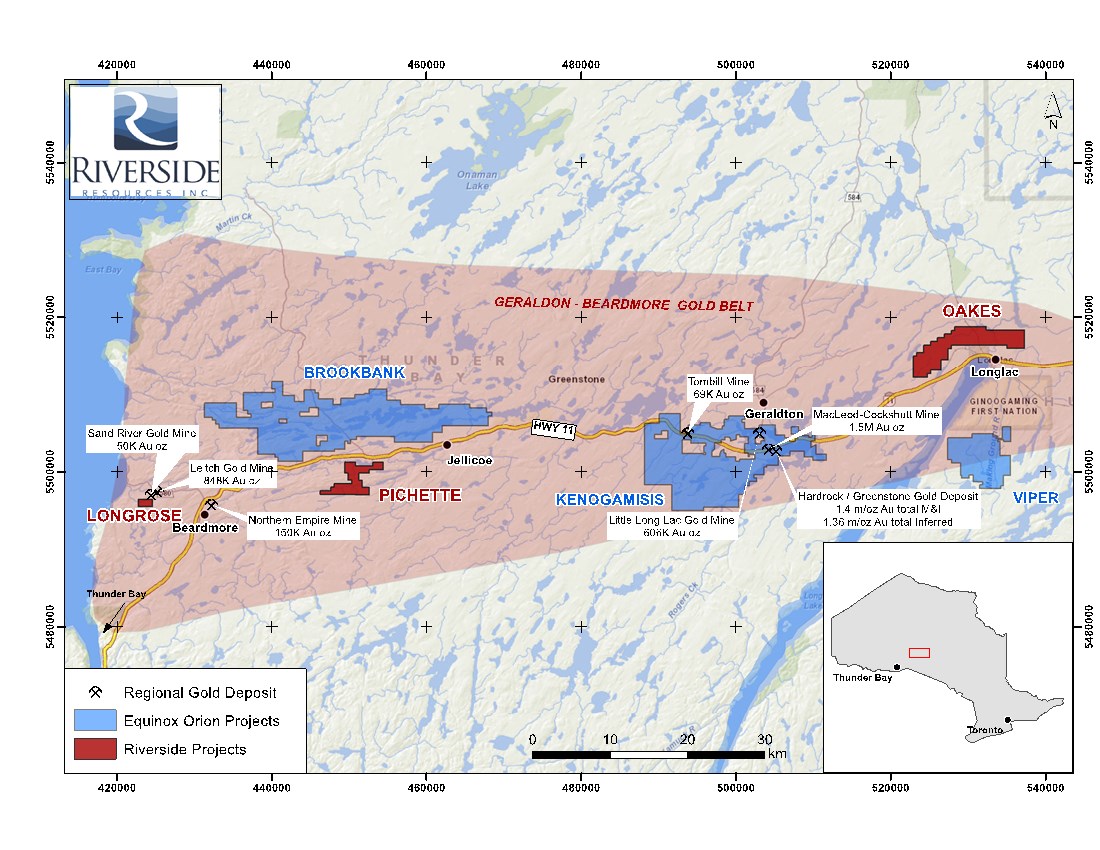

Figure 1: Riverside's Claims (in red) located on regional geology map. Historical production reports presented on figure are from the Ontario Geological Survey, OFR 5538.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6101/74114_c07c1f5254ef9ac3_002full.jpg

The BGGB is comprised of a series of northeast trending Archean metavolcanic and metasedimentary belts, divided into a northern, central and southern assemblage. The northern assemblage consists of mafic metavolcanic flows overlain by intermediate pyroclastics and capped to the south by a sulphide facies iron formation. Gold deposits in the BGGB district include the 4.6 Moz Hardrock deposit1 near Geraldton which was recently acquired by Equinox Gold Corp. from Premier Gold Mines Limited. The deposits are considered classic examples of epigenetic non-stratiform BIF-hosted gold deposits. Other notable deposits within the BGGB include the Brookbank (0.6 Moz M&I)2. Past production from the belt is estimated at 4.1M ounces which include the McCleod, Sand River and Leitch Mines (past production of 0.9 Moz)3, Northern Empire Mine and the Sturgeon River Mine.

Oakes Gold Project

The Oakes Project is located in Long Lac, Ontario east of Equinox's Hardrock deposit. Early exploration by Hardrock Mining and Noranda Exploration focused on base metals. Exploration for gold began in the 1990s with one successful drill program. Recent soil geochemistry, VLF and IP geophysics programs defined three, east-west oriented mineralized shear zones. This work was followed up by trenching and sampling along one of the IP anomalies, the HG Shear Zone where channel samples perpendicular to strike returned high-grade gold values of 19.7 g/t, 31.9 g/t and 6.9 g/t gold over 0.5-1.0 m. Grab sampling returned gold values of 46 g/t and 7 g/t, demonstrating a strike length of at least 600 metres. This a high priority drill target.

Pichette Gold Project

Pichette, lying west of the Hardrock Deposit, was first explored in the 1960's for nickel. Gold exploration commenced in the 1980's, with a successful drill program near the southern property boundary. In 1982, Canamax tested a porphyry associated with metasediments which returned positive results for gold. Recent work focused on the Pichette showing; a 4m wide shear zone associated with the Southern Banded Iron Formation. Historic surface grab sample highlights from the Pichette showing include: 24.55 g/t gold, 21.42 g/t gold and 16.01 g/t gold source.

Longrose Gold Project

The Longrose Project lies immediately west of the past-producing Leitch Gold mine where almost 1M ounces of gold was mined in the 1970s. Equinox Gold's Northern Empire mine is also close to the Longrose Project. Historic drilling at Longrose focused exclusively on quartz veins, ignoring the banded iron formation. Drill highlights include 30.8 g/t gold over 0.15m and 10.28 g/t gold over 0.45m from quartz veins (Longrose Gold Mines, 1947). Gold at Longrose is associated with folds within the banded iron formation a target that can be better defined using more modern IP surveys.

About Gowganda West

The Gowganda West property covers approximately 147km2 in the Shining Tree volcano-sedimentary succession of the southwestern Abitibi Greenstone Belt. The property hosts a number of exploration targets that are believed to be contiguous to the north and west to Aris (formerly Caldas) Gold Corp.'s Juby Gold deposit which comprises four mineralized alteration zones along the Tyrrell Shear Zone. Gold mineralization at Juby is associated with narrow quartz-carbonate-pyrite veins hosted within 20 to 330 metre wide zones of ankerite-albite-silica-sericite alteration and variable amounts of fine-grained, disseminated pyrite and also with multiple lenses containing narrow (<5m), higher grade quartz-carbonate-pyrite veins hosted within 5 to 50 metre zones of ankerite-albite-silica-sericite alteration with variable amounts of fine-grained, disseminated pyrite. The Juby Deposits host indicated resources of 774,000 ounces at 1.13 g/t Au and inferred resources of 1,488,000 ounces at 0.98 g/t Au. iMetal cautions investors mineralization at Juby is not necessarily indicative of similar mineralization at Gowganda West (Technical Report on the Updated Mineral Resource Estimate for the Juby Gold Deposit for Aris Gold Corp., 2020).

iMetal's acquired Gowganda West in 2016, discovering Zone 1 and Zone 3 through focused exploration proximal to the Aris property border, and subsequently completing prospecting, channel sampling, airborne VTEM, ground IP programs and a limited diamond drilling.

Zone 1 has excellent access and has been traced over 500m south onto iMetals property from the Juby property boundary. Two distinct outcrop areas approximately 300m apart have been sampled; Zone 1 and Zone 1 South. Highlight grab samples include: 6.47 g/t Au from Zone 1 and 39.3 g/t Au and 16.9 g/t Au from Zone 1 South. Six drill holes were subsequently drilled at Zone 1, focusing on a short 150 strike length of Zone 1S. Highlight drill intersections included: 2.95 g/t Au over 2.5 metres, 1.43 g/t Au over 4.6 metres and longer intervals of 0.37 g/t au over 29.4 metres and 0.32 g/t au over 30.25 metres (Gamble, Oct. 21, 2020).

Zone 3 consists of two distinct area, 3A and 3B approximately 6 kilometres due south of Zone 1, separated by 225 metres. Highlight Zone 3A grab sample results include 56.59 g/t Au and 34.81 g/t Au, while highlight Zone 3B grab sample results include 14.74 g/t Au and 12.7 g/t Au. Zone 3A and Zone 3B remain undrilled (iMetals NR dated Jan. 15, 2021).

Qualified Person & QA/QC:

The scientific and technical data contained in this news release was reviewed and approved by Freeman Smith, P.Geo, a non-independent qualified person to Riverside Resources, who is responsible for ensuring that the geologic information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Regarding previous historical operators work and resource estimates: The reliability of historical data is uncertain but is considered to be relevant by Company management for focusing exploration work; however, all past work will have to be examined and resampled for the purposes of reporting.

About Riverside Resources Inc.:

Riverside is a well-funded exploration company driven by value generation and discovery. The Company has no debt and less than 69M shares outstanding with a strong portfolio of gold-silver and copper assets in North America. Riverside has extensive experience and knowledge operating in Mexico and Canada and leverages its large database to generate a portfolio of prospective mineral properties. In addition to Riverside's own exploration spending, the Company also strives to diversify risk by securing joint-venture and spin-out partnerships to advance multiple assets simultaneously and create more chances for discovery. Riverside has additional properties available for option, with more information available on the Company's website at www.rivres.com.

ON BEHALF OF RIVERSIDE RESOURCES INC.

"John-Mark Staude"

Dr. John-Mark Staude, President & CEO

For additional information contact:

John-Mark Staude

President, CEO

Riverside Resources Inc.

Phone: (778) 327-6671

Fax: (778) 327-6675

Web: www.rivres.com

Raffi Elmajian

Corporate Communications

Riverside Resources Inc.

Phone: (778) 327-6671

TF: (877) RIV-RES1

Web: www.rivres.com

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., "expect"," estimates", "intends", "anticipates", "believes", "plans"). Such information involves known and unknown risks -- including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Riverside in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 G Mining Services Inc. (Louis-Pierre Gignac, P.Eng et el), December 2016: NI 43-101 Technical Report Hardrock Project, Ontario, Canada for Greenstone Gold Mines

2 Micon International Inc. Alan J. San Martin, and Charley Murahwi, (2012). Technical report on the Mineral Resources Estimates for the Brookbank and KeyLake projects Trans-Canada Property Beardmore-Geraldton Area Northern Ontario Canada Dated December 14, 2012.

3 Mineral Deposit Inventory for Ontario, Ministry of Energy, Northern Development and Mines, Record: MDI52H09SE00004 (Leitch Mine).

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/74114